What is capital gains tax and what is the capital gains tax rate for 2021 and 2022? A capital gains tax is a levy on the profit made from an investment when the investment is being sold. In other words, profit made from the sale of an investment, such as real estate or shares of a stock, is subject to capital gains tax.

How much the gains are taxed depends on how long the investment was held before selling. Investments or assets held for a year or less are known as “short-term capital gains”. While investments or assets held for a year or longer are known as “long-term capital gains.”

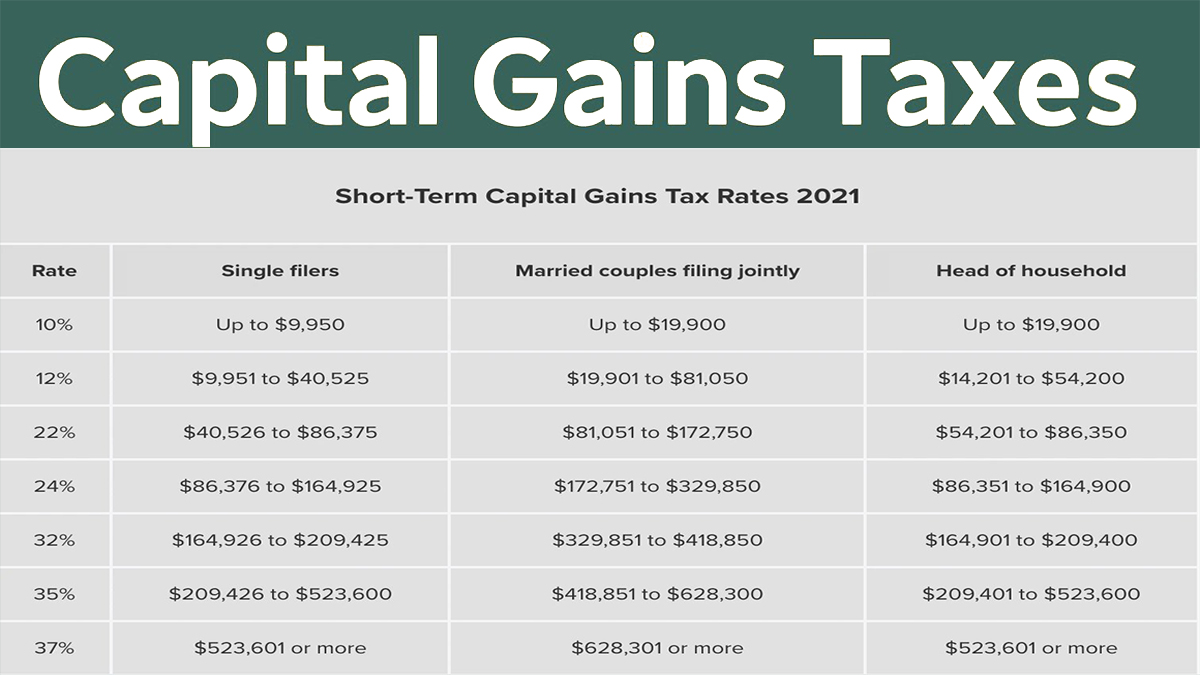

In 2021/2022, the capital gains rates are either 15%, 20%, or 0% on most investments or assets held for more than a year. Most capital gains tax rates on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, or 38%. However, you need to know that capital gains taxes are only due after an investment is sold.

What is Short-Term Capital Gains Tax?

Before moving to the 2021 and 2022 capital gains tax rates, let’s talk a little about the short-term capital gains tax. Just like I have mentioned above, short-term capital gains is a tax on profits from the sale of an asset held for one year or less than a year. The tax rate is equal to your ordinary income tax rate (your tax bracket).

What is Long-Term Capital Gains Tax?

This type of capital gains tax is a tax on profits from the sale of an investment or assets held for more than one year. Depending on your taxable income and filing status, the long-term capital gains tax rate is 0%, 15%, or 20%. It is lower than the short-term capital gains tax rate.

Capital Gains tax Rates

Below are the 2021 and 2022 long-term capital gain tax rates. Check them out.

| Tax filling Status | Single | Married, filling jointly | Married Filing separately | Head of household |

| 0% | Up to $40,400 | Up to $80,000 | $0 to 40,400 | Up to $54,100 |

| 15% | $40,401 to $445,850 | $80,801 to $501,600 | $40,401 to 250,800 | $54,101 to $473,750 |

2022 Capital gains tax rates

| Tax – filing status | Single | Married, filing jointly | Married, filing, separately | Head of household |

| 0% | Up to $41,675 | Up to $83,350 | Up to $41,675 | Up to $55,800 |

| 15% | $41,676 To $459,750 | $83,351 to $517,200 | $41,676 to $258,600 | $55,801 To $488,500 |

| 20% | More than $459,751 | More than $517,201 | More than $258,601 | More than $488,501 |

Short-term capital gains are always taxed as ordinary income according to the federal income tax brackets. You can check out websites like NerdWallet to use their tool to estimate your after-tax investment gains.

How are Capital Gains Taxes Calculated?

Now, let’s talk about how the capital gains taxes are calculated. Below are a few points. Check them out;

- Capital gains taxes can apply to assets such as bonds or stocks, real estate, boats, cars, and other tangible items (though usually not your home).

- The profit made on the sale of any of the above items is your capital gain. The profit you lose is your capital loss. You can check out a capital gains tax calculator online to help you estimate your gains.

- You can make use of investment capital losses to offset gains. If you sold your stock for a ten thousand dollar profit this year and sold another for about a $4,000 loss, you will be taxed on capital gains of $6,000.

- The difference between your capital losses and your capital gains for the tax year is known as “net capital gain.” However, if your losses exceed your gains, you have what is called a “net capital loss.” You can also use it to offset your ordinary income up to $3,000, or $1,500 if married filing separately.

Any other losses can be carried forward to future years to offset capital gains up to $3,000 of ordinary income in a year. Capital gains taxes are progressive and they are a little like income taxes.