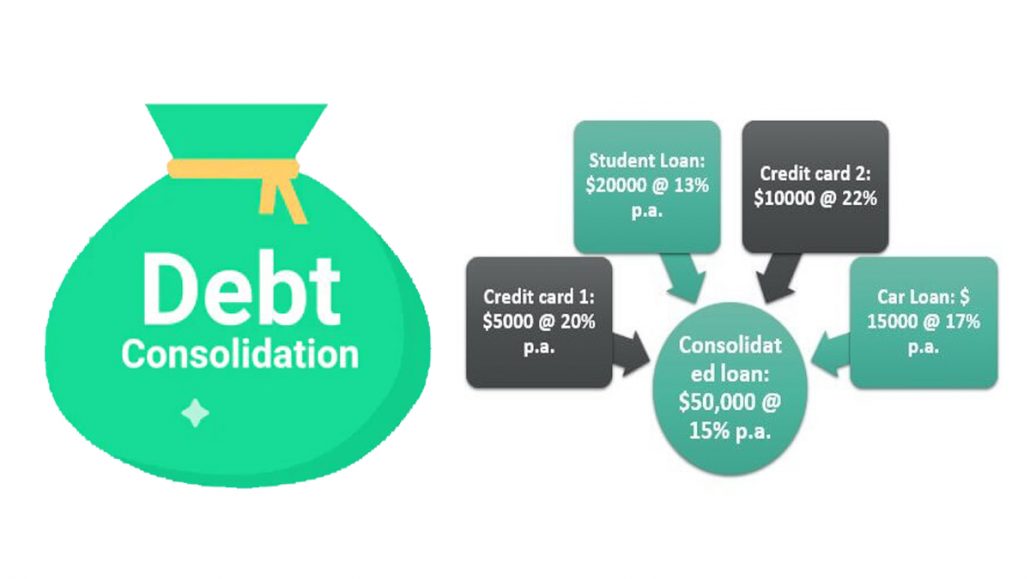

A debt consolidation loan is a type of loan which assists you to combine high-interest debts into a single new one. This loan is a personal loan that joins and amalgamate all of your high-interest dues and makes it one loan.

It is a refinancing loan that implies you taking out one loan to pay other loans. To collect a Debt Consolidation Loan, you will be taking out a new loan to pay off one or more existing loans that you have. You can also pay payday loans, credit card bills, personal loans, medical bills, and interest-based loans.

It is the best way to pay up your high-interest-rate loans faster and easier. Instead of numerous payments, with a Debt Consolidation Loan, you will just make a single payment and pay up your dues. It also you to save money however, it is not guaranteed.

You can also use it to secure a lower interest rate. Your credit score is used to determine the Debt Consolidation Loan you can apply for.

How Does Debt Consolidation Loan Work?

With the help of a Debt Consolidation Loan, you can easily pay off your debt. And there are various companies which offer this loan. By combining all your multiple debts, you can easily and quickly pay them up. Unsecured loans are available through credit unions, banks, and online lenders.

The interest in it is not compounded. Therefore, before you apply for this loan, you need to consider some factors to complete the process.

What Should I do Before I Apply For a Debt Consolidation Loan?

Before you apply for a Debt Consolidation Loan, you need to look around and find the one that suits you and offers you the best services, You must also avoid scams, consider alternatives, create a repayment budget and plan. Most importantly, make and develop a plan to avoid any new debt.

How do I Know if I am Eligible For a Debt Consolidation Loan?

To know if you can apply for a Debt Consolidation Loan, the lenders of the loan will always consider your income, your credit history, and your credit score. These factors will always display your eligibility for a Debt Consolidation.

How Can I Get a Debt Consolidation Loan?

To be able to get a Debt Consolidation Loan requires a few steps. These steps include prequalifying, selecting your loan terms, finalizing your application, and then closing. Prequalifying is the use of s soft credit check to create a rate quote. This rate quote will now estimate the minimum loan amount that you are eligible and approved for.

The interest rate is also included. Then the lender will take a look at your credit score to see if you are worthy of the loan. However, be sure that you analyze these steps before you apply for this loan. Go to a Debt Consolidation giving company and complete the process for the loan.

What Are Some Debt Consolidation Loan Companies?

Various companies offer Debt Consolidation loans and some of them include; Rocket loans, Upgrade, Discover, Lending Point, PNC bank, LendingClub, OneMain Financial, Freedom Plus, Axos Bank, US Bank, TD Bank, Best Egg, Upstart, Payoff, LightStream, and many more.