Taking a loan with bad credit seems almost impossible, but it is not. Loans with poor or bad credit can be very challenging to get, but knowing how to get a loan with bad credit will make the process easier. Most lenders do not offer loans to borrowers with poor credit, but others do. While you search for loans with bad credit, comparing interest rates. And loan terms will help you find the best loan for your situation.

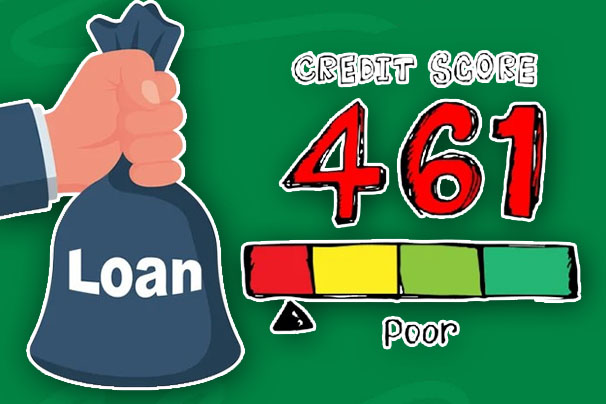

There are different steps you can follow to get loans with bad credit. One of these steps is working on your credit and paying off old debts. A credit score is an important factor lenders consider before approving loans; it is used to determine interest rates, and it can affect your loan approval. This means you may not be approved for a loan.

However, some lenders allow borrowers with bad credit to apply for loans with a co-signer or co-borrower. Generally, borrowers with bad credit face high interest rates when applying for loans, but through different methods, you can get personal loans with bad credit as well as lower interest rates.

Things to Know Before Taking a Loan with Bad Credit

Taking loans with bad credit can be difficult because lenders tend to focus more on your credit score than other factors. Having bad credit makes them consider you a high-risk borrower. If you have a credit score as low as 580, most lenders may not approve your loan, while other lenders will but will charge higher interest rates.

Some lenders will require collateral on the loan to archive their money back if ever you default on the loan. Also, some lenders allow co-borrowers on the loan to give borrowers a better shot at loan approval and lower interest rates. However, the co-borrower is required to have good credit and a stable income. Before applying for loans, review the interest rates and fees attached to the loan.

How To Get A Loan With Bad Credit

Borrowers with a credit score of 670 and above stand more chance of getting approved for loans with lower interest rates than those with poor or bad credit. While we have this, the following are steps on how borrowers with bad credit can get loans.

Comprehend Your Credit Score

Since your credit score displays your creditworthiness and is the main factor lenders consider, it is important to understand your credit. Check out why you have bad credit and how you can fix it. To do this, get a copy of your credit history, read through it, and search for errors that affect your credit score negatively. Doing this can help you indicate mistakes you can correct to improve your credit.

Boost Your Credit

Boosting your credit score is a fast process but it is worth doing. Through this process, you can easily apply for loans and get better interest rates and loan terms. Some of the ways you can improve your credit are by paying off outstanding bills, lessening the debt you owe, and avoiding the creation of too many credit accounts.

Shop for Lenders

As previously stated, not all lenders look into credit in the same way. Some lenders offer loans to borrowers with bad credit. Instead of focusing on the credit, they consider other factors like the borrower’s income and place of study when determining loan terms and rates. Shopping around for lenders willing to offer loans to borrowers with bad credit is a vital way to find the best lender.

Prequalify for Loans

Before officially applying for loans and submitting your application, ensure you prequalify for loans from different lenders. Doing this allows you to access their loan rates and terms to see which you qualify for. This process does not affect your credit score.

Apply for the Loan

After selecting your preferred lender, proceed with the application process. Ensure you provide all the required documents and information for the application process and follow up on your application just in case any other information is required.

Consider Getting a Co-borrower or Collateral

If you still cannot get a loan with bad credit, consider getting a co-borrower or collateral to help your application. Getting a co-borrower depends on whether or not the lender accepts it and this borrower is required to have a good credit and stable income. While getting an unsecured loan may be impossible, consider getting a secured loan, which requires collateral for loan approval.

Where Can I Get a Loan With Bad Credit?

It takes a long time and effort to get a loan with bad credit but there are different types of lenders you can get a loan from. These lenders include the following:

- Online lenders.

- Credit unions.

- Traditional banks.

From these lenders, borrowers with bad credit can apply and get approved for loans with flexible loan terms and interest rates.