The SBI personal loan is here for you, to help you with your urgent and personal emergencies that deal with money. SBI personal loan is the number one best place you apply for a loan in India. SBI, an abbreviation for State Bank of India is one of the top lenders based on the interest rate, loan tenure, and amount, fees for processing, and other charges as well. The Indian economy is currently going through a phase of strong-rooted financial growth which is making them keep encouraging individuals and entities to spend more. This however brings good news for the unsecured market where a large number of individuals are profiting from personal loans to meet short-term immediate financial goals.

If you are not able to decide if you should apply for the SBI loan or not. One of the convenient and simplest ways to calculate loan repayment is to make use of the SBI personal loan EMI calculator which is available at Groww. The SBI personal loan interest rates are lower for existing customers of the bank with a strong CIBIL score and for those working with reputed corporations with stable pay. They offer pre-approved personal loans at low rates for customers with strong credit history and existing accounts with the bank.

Types of SBI Personal Loans

If you have a salary account with the SBI, you can apply for the SBI Xpress Credit Personal loan for cash requirements like medical emergency, vacation, wedding, and so on. The following are the types of SBI loans available.

- Xpress Elite Scheme Personal Loan

- Pension loan

- Xpress Credit Personal Loan

- Xpress Credit Insta Top up Personal Loan

- Xpress Credit Non Permanent Employees Personal Loan

- Pre Approved personal Loan

- Clean Overdraft Personal Loan

- Quick Personal Loan

The above-mentioned types of SBI loan interest rates may change and shall depend on the sole discretion of SBI.

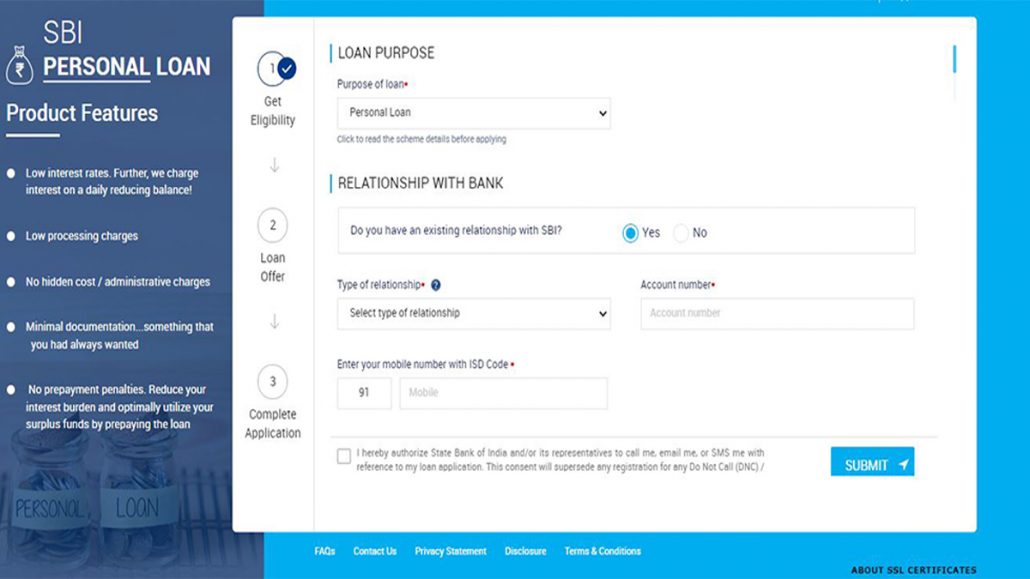

SBI Personal Loan Apply Online

For you to apply for the SBI personal you must follow the required process to apply and your requested document must be complete. The following are the ways you can apply for the SBI personal loan.

- Visit the SBI personal loan application page on your device browser.

- Selext ”Personal Loan” from the purpose of loan field.

- Select yes or no if you have relationship with the bank

- Select type of relationship

- Enter your account number

- Enter your mobile number with ISD code

- Click on the submit icon

With a few clicks of a button, you will be done with the application process. In conclusion, SBI loans have low-interest rates, low processing charges, and no prepayment penalties.