W9 Form also known as Form W-9 is an IRS form majorly used to provide some necessary information to a person or company which would be making payments to another person or company. Most times, it is when a person works independently as a business contractor that this kind of form is used. This implies that before you apply for a job with a company as their business contractor, some companies might require you to fill the W9 form.

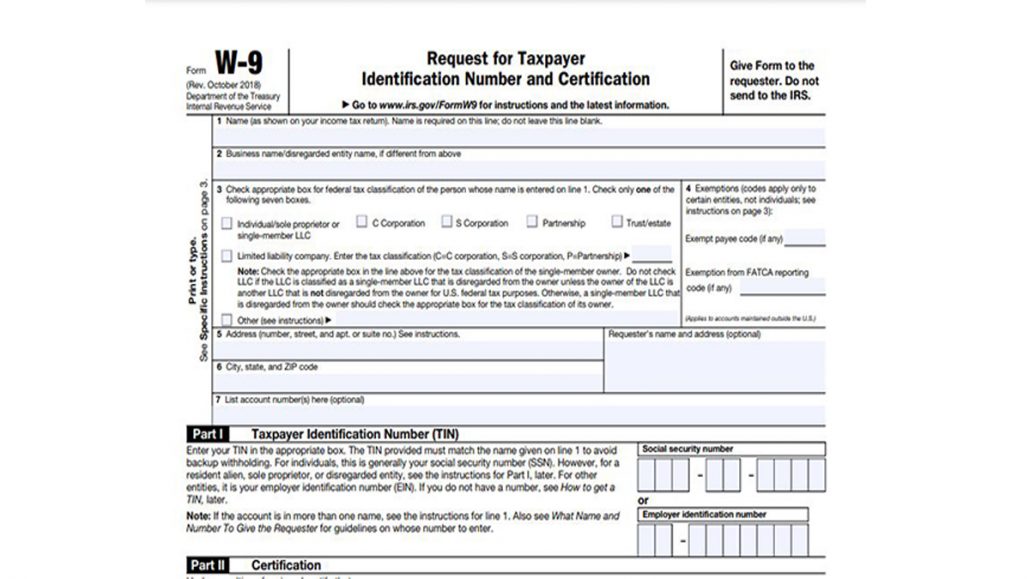

The W9 form is majorly used to confirm a person’s name, address. Also, it must include TIN which is the Taxpayer identification number for employment or any other source of making income purposes. The certification form is a formal written request for information only and is to confirm an individual TIN. So, an employer or any other entity is asked to file a document of information with the IRS. The form must contain your correct TIN so that any earnings or losses that may affect your federal tax return or your taxable income.

What Information Is Required On A W9 Form?

On a W9 Form, there is some certain information that would be required of you. But before you file this information, you must check to ensure that your business contractor has already filled in the information required of them. This information includes;

- Name of the Payee or the business name of the payee if he has one

- The payee current mailing address

- The Payee TIN

- The Payee Code (optional).

Once the payee has filled in all this information and some others that would be required of them. You as the company can now file the information of the payee or business contractor.

When To Request For A W9 Form

As a company owner, you are to request a W9 when doing business with an independent contractor or a freelance worker. Take, for instance, you have a company that pays a particular person about 700 U.S. dollars for work done. And you by yourself didn’t employ those people, you are to request from them a W9 form with their details on it. After getting the W9 form from the contractor, you are to keep it well to be able to use it at the end of the year to make a report of how much the contractor has earned from you.

Why is W9 Form Very Important?

W9 forms are very important because they enable the IRS to identify and get information that has to do with an independent contractor. Who might attempt to avoid claiming their income for tax purposes? Also, another importance of a W9 form is to help prevent a company from claiming any expenses that are counterfeit.