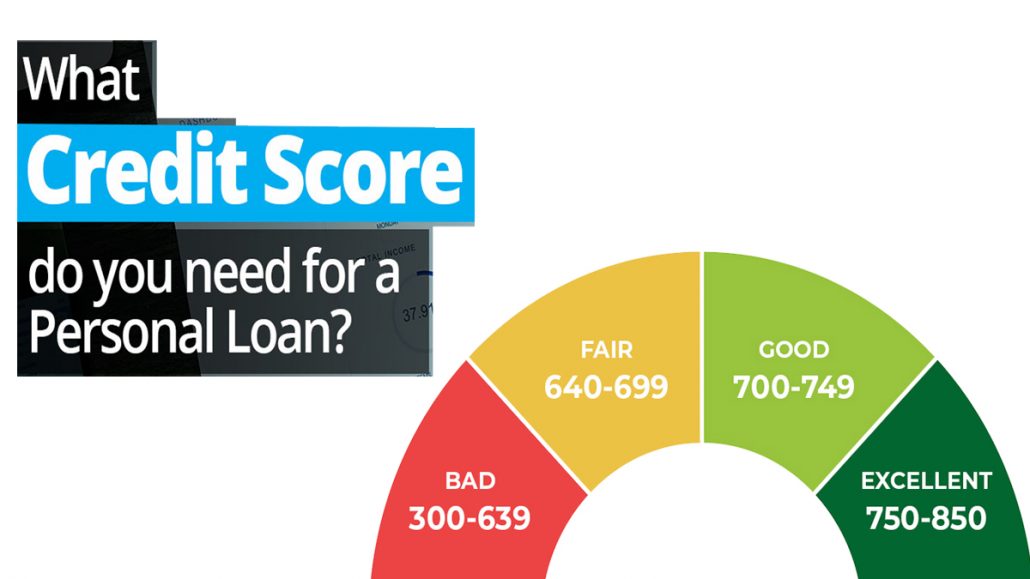

What credit score do I need for a personal loan? If you have been wondering about the right credit score you need before you can apply for a personal loan, then this article is highly recommended. First and foremost, Credit score qualification for personal loans differs with money lenders. But according to research, there are acceptable credit scores by lenders.

Furthermore, your credit score is one of the key factors to determine if your loan application will be approved by most money lenders. However, many lenders will prefer to approve loans of borrowers with great FICO credit scores like 690.

But still, there are some lenders who offer loans to individuals with bad or poor credit like 630 and below. Still, having an excellent credit score does not entirely guarantee that your loan application will be approved. Your loan application will be approved based on your creditworthiness.

What You Need to Qualify For a Personal Loan

Most times even when you meet with a lender credit score requirement that doesn’t mean your loan application will be approved. Some lenders have basic qualifications to consider your loan application. Here is what some lenders look at to approve your loan application.

- Credit Score: for many lenders, this is the key factor to determine your creditworthiness. Lenders make use of FICO credit scoring system to score you. There are other lenders that will approve loans of borrowers with bad credit history.

- Credit History: Your credit history is also part of what some lenders look at on your loan application. Hence, most lenders love to see a long historical record of your credits. But, the minimum credit history required is two or three years. Nevertheless, it is important to know that lengthy credit history will show lenders prove that you are diligent in paying back your loans. Meanwhile, borrowers with a credit history of a mortgage or car loan with on-time payment have a better advantage.

- Debt-income-ratio: lenders also seek your Debt-to-income ratio to know how much is your financial monthly obligations. Your Debt-to-income-ratio will tell lenders if you can pay back your loan. Also, it shows if you are diligent in repaying back your loans.

Minimum Credit Score For a Personal Loan

The minimum credit score requirement for any borrower is 610 to 640. Therefore to get a personal loan, you need to have a fair credit score. Also, you will need a debt-to-income ratio of 40%. A fair credit score is 630-689.

What is the Minimum Credit Score For a Personal Loan in a Credit Union?

The credit union is the best place to apply for a personal loan because they offer flexible loan requirements. If you want to borrow any money, your Credit union should be your number one stop. Also, if you have poor credit or a bad credit score, your credit union would still loan you the money you need. For most credit unions the minimum credit score is usually below 690. Also, personal loans from credit unions usually come with lower interest rates and more flexible terms and conditions.